When Can You Refinance Your Car

Can You Refinance Your Car Loan?

You can think of refinancing your car to a lower interest rate if your credit rating has improved since you bought the car or you failed to qualify for an affordable rate of interest earlier for any reason. A lot of money can be saved by getting cars refinanced and besides, the entire process for auto loan refinancing is less complicated than that of home refinancing. Nevertheless, qualifying for refinance car loan might not be that easy and the task may require you to seek help from a competent expert.

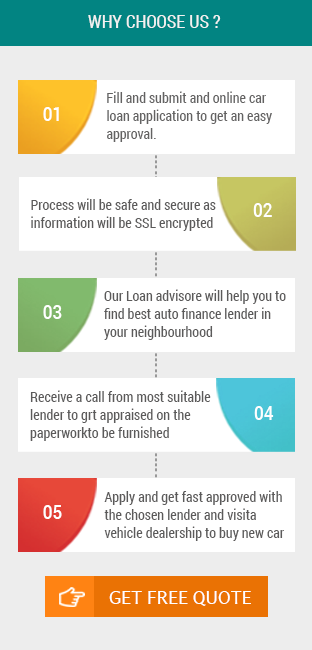

CarLoanStudent can assist you to locate knowledgeable and experienced professional who can guide you in navigating through the auto refinancing procedure with ease and enable you to qualify for a loan that fits your budget.

When Can You Refinance Your Car Loan?

Your ability to get your car refinanced could depend on a variety of factors, one of them being your current financial situation. If you have good credit then obtaining a refinance auto loan may not be that difficult but if your credit score is bad, you could face a hard time when getting your application approved. But some online lenders may approve your request if you agree to pay a down payment.

Another crucial factor which might affect your chances of getting a bad credit car refinancing loan approval is the existing market situation. Ever since the bout of economic downturn ushered in, not many loan dealers show willingness to work with individuals who have poor credit. Hence, the question may be not just “Can you refinance a car?” but it might be the timing that is equally vital.

At CarLoanStudent, our specialists first enable you to determine whether refinancing car is right for you.

Get Started NowFor A Free No Obligation Quote..!Can You Afford To Refinance Your Car Loan?

While it could be possible to get your vehicles refinanced to a lower rate, here are few things which you need to consider before you start researching various auto loan refinancing options.

- Overall Costs Of The Loan : Although costs involved in refinancing cars could be nominal as compared to mortgage refinancing, some lenders may charge some fees upfront when you apply. But there could be some other loan dealers that might not charge any fees unless you qualify for an auto refinance loan and sign an agreement. Normally, these charges are rolled into the loan amount as a result of which monthly car payments may get hiked marginally. To reduce monthly instalments, you have to consider paying money from your own pocket.

- Your Current Loan Amount : Prior to considering refinancing your car, it is essential that you review the status of your present auto loan. To that effect, contact your original car finance lender and find out how much dues are still being owed. There are specialized lenders online that can offer you 100% refinancing loans but to obtain an approval from one of them, you need to make sure that you have been current on your existing car loan payments for the past 1 year.

- The Total Amount Of Savings : Refinancing enables huge monetary savings and it is with this objective in mind that people opt for it. However, it could be important for you to determine the exact amount of money you can save if you get your vehicle refinanced to a lower rate. Remember, refinancing involves certain costs by way of closing costs or pre-payment penalties. To recover them, it will take some time. So if your new interest rate must be lower by at least 2% points.

When Can You Refinance A Car?

If you have just purchased a new car then there is no point in waiting for getting it refinanced. This is because refinancing could allow you to get access to the lowest interest while the vehicle still has a lot of value.

When Should You Refinance a Car Loan?

You could consider getting your car refinanced if:

- Your credit score improved vastly giving you the chance to secure a lower interest rate

- You couldn’t get an affordable auto loan earlier for whatever reasons as a result of which monthly payments are high

Is There A "Best" Time?

The best time to refinance your car is when:

- Interest rates in the market have fallen drastically

- Your vehicle is still new and has a good selling price

However, to enhance chances of obtaining car refinancing approval, you need to prepare accurate paperwork.

How Early Can You Refinance A Car?

The process of refinancing can be a complicated one but if you are thinking, “How soon can you refinance your car?” then here is some piece of information which you may find highly useful.

- Refinancing : It is a process of replacing original high interest car loan with new ones that have a much lower rate of interest, extended loan duration and easily affordable monthly payments.

- Fees : In most states of the U.S., borrowers, who refinance cars, are required to pay charges in order to cover up the operational expenses involved in the entire auto refinancing process.

- Interest : By refinancing your car, you can save money on interest. But if any interests on original auto loan are unpaid, it might get added to new loan making it costlier.

- Considerations : Majority of the lenders offer car refinance loans with 5 or 6 year terms. But it could be important for you to do a cost benefit analysis involving current loan vs refinancing.

Auto Loan Quote

Get Approval Within a Minute, All Credit

Accepted 99% Applications Approved

Your privacy and security are important to us.

Get Approved Auto Refinance

In Just 60 Seconds, Quick Approval!!!

Need Student Car Loan? Apply Right Away To Get Approved.

Need Student Car Loan? Apply Right Away To Get Approved.

Buy Your Dream Car Today at lowest interest rates.

Buy Your Dream Car Today at lowest interest rates.

No Credit? Don't Worry We Provide Car Loan With No Credit.

No Credit? Don't Worry We Provide Car Loan With No Credit.

Click For CANADA

Click For CANADA