Know How Many Times Can You Refinance A Car Loan

Can You Refinance A Car Loan?

Can you refinance an auto loan? Well, almost every person who has bad credit and owning a car may be asking this question to himself. In any case, the answer is certainly YES. Getting a car refinances is very much like getting a mortgaged refinanced, in fact the process could be even simpler than that. But there could be variety of factors which might influence your ability to refinance a vehicle loan to a lower rate. So if you are considering applying for car refinance loan then it could be vital for you to have some understanding of these parameters.

When Can You Refinance A Car Loan?

If you are a driver in your 20s who is thinking, “Can you refinance your car loan?” here is some useful piece of advice. The main objective for considering an auto loan refinance is to:

- Get access to a lower interest rate

- Reduce your monthly car payments

- Pre-pay existing high interest car loan

- To secure the lowest and the best auto refinance interest rate for your specific financial situation, you must shop extensively and compare free proposals offered from several different loan dealers.

- For securing lower rate on car financing loan, it could be advisable for you to take effective steps for building or improving your credit score if it is in poor standing.

- You must at least have a part-time job which fetches you at least $1,500 every month for proving your ability to pay monthly refinance car payments regularly.

While the goal can be achieved, to make that a practical reality, it will be better if you take the below mentioned aspects.

Can You Refinance A Car Loan With A Co-signer?

If you got your car financed at a higher interest rate because of having bad credit or whatever other reasons, you may think of getting benefitted with a lower auto refinancing rate so as to reduce the risk of developing of negative car equity. But in such a situation, can a co-signer be of any help? Let’s see how things can work.

Who Can Co-sign?

Co-signer need not necessarily be a family member, even a close friend can co-sign a car refinance loan provided he has a FICO score which is above 700 and has a stable, steady as well as sufficient monthly income. Lenders verify financial capacity of co-signer as well as may also run credit checks before approving bad credit auto loan refinancing applications. To that effect, co-signer must offer proof that he has the ability to repay dues if the borrower defaults on payments.

Respecting Better Rates on Your Refinanced Auto Loan

If any person agrees to be a co-signer to help you out with your car refinancing task, you have the chance to save money by refinancing your car. Nevertheless, as co-signer is financially responsible on your behalf, it could be important for you to ensure that you don’t miss any payments. Consistent defaults can adversely affect the co-signer’s credit rating as well. Besides, if you are likely to default on a monthly payment, you must it to convey it to your co-signer.

Taking the Leap

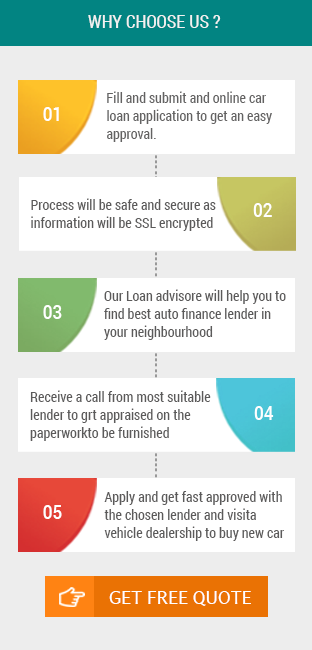

Regardless of whatever may be the status of your credit history, once you have decided to go ahead with car refinancing, never look back. CarLoanStudent will guide you in navigating through the process with ease. Take advantage of our cost-free specialist services online for finding an auto refinance loan that fits your budget. Benefit with a totally streamlined online application procedure that hardly takes few seconds to complete.

Get Started NowFor A Free No Obligation Quote..!How Long Can You Get A Car Loan For?

People who wonder, “Can you refinance car loan?” must know that loan terms chosen can have an impact on monthly payments as well as money which can be saved. It is not always true that loans with longer durations are better propositions than those with little shorter terms. Let us see that for ourselves here.

- Consider Interest Costs For 84 Month Auto Loans : Monthly car payments for a loan with 7 years duration may be lower as compared to those for loans with 5 year loan terms. But the amount of money that will be spent on interests all along the life of the bad credit car refinance loan could be considerably higher.

- You Will Have To Deal With Negative Equity Sooner : New car values depreciate faster and as a result, if you opt for a loan with 7 year term, there are chances that you might go upside down on it. This inversely implies you may have to deal with negative equity situation much quicker than anticipated. However, a lot could depend on the type of car driven and amount of down payment you have paid.

- Your Car Isn’t Right For Your Family Anymore : If you find yourself in a situation wherein you discover that the car you bought doesn’t serve your purpose any more after years have passed then you do will have little chance to refinance since the vehicle has lost its value. In such case, you could consider trade-in of old car to buy a new one that fits your needs.

- Resale Value Of Your Vehicle Will Diminish : Other than huge interest costs, the main disadvantage of getting a 84 month term auto loan is that after such a long period, the car loses its resale value. As compared to that a vehicle which has been financed with a 3 or 5 year loan duration will still have some resale price in market.

- Finance a Vehicle Which Is Easier to Afford : Never buy a car which you can’t afford to keep, instead it could be much better if you thought of buying a cheap used car which is in a good condition and has excellent mileage. By doing so, you will save money on premium, reduce chances of going upside down on your loan and secure more affordable monthly car payments.

- As We See It : At CarLoanStudent, we don’t recommend our customers to get auto refinance loans which have durations of 5 years or more unless their situations really warrant such terms. Till date we have successfully enabled hundreds of borrowers find car refinancing loans that work best for their budget. To know more about our services, apply online now!

Auto Loan Quote

Get Approval Within a Minute, All Credit

Accepted 99% Applications Approved

Your privacy and security are important to us.

Get Approved Auto Refinance

In Just 60 Seconds, Quick Approval!!!

Need Student Car Loan? Apply Right Away To Get Approved.

Need Student Car Loan? Apply Right Away To Get Approved.

Buy Your Dream Car Today at lowest interest rates.

Buy Your Dream Car Today at lowest interest rates.

No Credit? Don't Worry We Provide Car Loan With No Credit.

No Credit? Don't Worry We Provide Car Loan With No Credit.

Click For CANADA

Click For CANADA